Get This Report on Vancouver Accounting Firm

Wiki Article

About Pivot Advantage Accounting And Advisory Inc. In Vancouver

Table of ContentsRumored Buzz on Cfo Company VancouverCfo Company Vancouver Fundamentals ExplainedFascination About Small Business Accounting Service In VancouverVirtual Cfo In Vancouver for BeginnersSmall Business Accountant Vancouver Fundamentals ExplainedGet This Report on Virtual Cfo In Vancouver

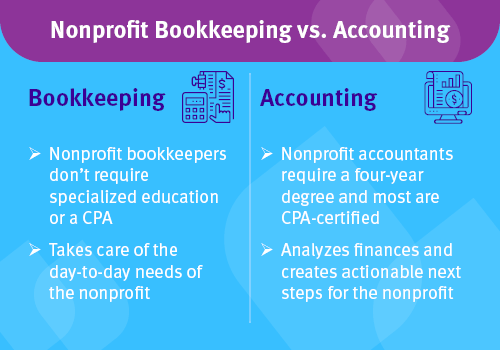

Here are some advantages to working with an accountant over a bookkeeper: An accounting professional can provide you a detailed sight of your company's financial state, in addition to approaches and also recommendations for making economic choices. Accountants are just responsible for recording economic purchases. Accounting professionals are needed to complete more education, accreditations as well as job experience than bookkeepers.

It can be difficult to gauge the suitable time to hire an audit professional or accountant or to establish if you require one in all. While lots of local business hire an accounting professional as a consultant, you have numerous alternatives for taking care of economic tasks. For instance, some small company proprietors do their very own accounting on software application their accounting professional suggests or utilizes, giving it to the accountant on a weekly, regular monthly or quarterly basis for activity.

It might take some history research to discover a suitable accountant since, unlike accountants, they are not required to hold a specialist certification. A strong recommendation from a relied on colleague or years of experience are very important factors when employing a bookkeeper. Are you still unsure if you need to work with someone to assist with your books? Right here are 3 instances that suggest it's time to hire an economic expert: If your tax obligations have ended up being too intricate to manage by yourself, with several revenue streams, international investments, a number of reductions or other considerations, it's time to hire an accounting professional.

Tax Consultant Vancouver for Beginners

For small companies, proficient cash management is a vital facet of survival and also growth, so it's smart to deal with a monetary professional from the beginning. If you favor to go it alone, take into consideration starting out with audit software and maintaining your books diligently up to date. This way, should you need to employ an expert down the line, they will certainly have exposure into the total monetary history of your organization.

Some resource meetings were carried out for a previous variation of this short article.

Some Known Questions About Outsourced Cfo Services.

When it concerns the ins and also outs of tax obligations, audit and financing, nevertheless, it never harms to have a knowledgeable expert to count on for assistance. A growing number of accountants are additionally looking after points such as capital projections, invoicing and also human resources. Inevitably, numerous of them are handling CFO-like duties.For instance, when it came to requesting Covid-19-related governmental funding, our 2020 State of Small Company Study discovered that 73% of small company owners with an accountant stated their accounting professional's advice was very important in the application process. Accounting professionals can additionally assist local business owner prevent costly errors. A Clutch survey of little business owners programs that more than one-third of tiny organizations list unpredicted costs as their top economic difficulty, followed by the blending of business and also personal funds as well as the failure to obtain payments in a timely manner. Tiny organization proprietors can expect their accountants to assist with: Choosing the organization framework that's right for you is very important. It affects just how much you pay in taxes, the paperwork you require to file as well as your personal obligation. If you're seeking to convert to a different business structure, it can cause tax effects and other problems.

Even business that are the same dimension as well as sector pay extremely various amounts for accounting. These prices do not convert right into money, they are essential for running your company.

More About Small Business Accountant Vancouver

The average cost of accountancy solutions for tiny business differs for each one-of-a-kind circumstance. The average regular monthly accountancy fees for a little business will increase as you add more services and the tasks obtain tougher.For instance, you can record deals and also procedure pay-roll making use of online software. You enter quantities right into the software program, and also the program computes overalls for you. In some situations, payroll software application for accountants enables your accounting professional to use payroll processing for you at extremely little extra cost. Software services can be found in all sizes and shapes.

Not known Factual Statements About Cfo Company Vancouver

If you're a brand-new company proprietor, do not forget to aspect bookkeeping expenses right into your budget plan. Administrative expenses and also accountant fees aren't the only accounting expenses.Your ability to lead staff members, offer consumers, and also make decisions could endure. Your time is additionally useful and need to be considered when considering accounting prices. The time invested on bookkeeping jobs does not produce earnings. The less time you invest in bookkeeping and also taxes, the more time you have to expand your business.

This is not intended as lawful advice; for even more info, please click below..

outsourced CFO services

The Ultimate Guide To Vancouver Accounting Firm

Report this wiki page